T. Bailey Performance Update Q2 2024

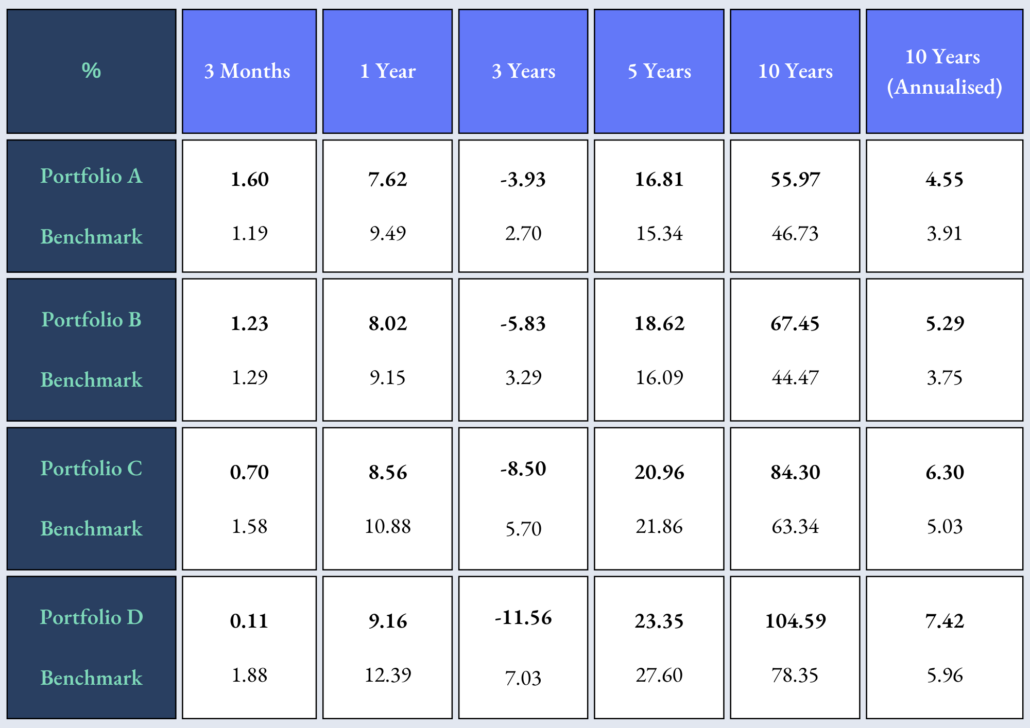

The funds delivered a positive return over the quarter, ranging from 1.60% to 0.11% and performed strongly over 12 months to the end of June. The US continued to lead the way but was once again dominated by a very narrow selection of tech stocks. The S&P 500 was up 3% over the quarter, but the same equal-weighted index was down by 3%, demonstrating there were actually more losers than winners. For much of June, the impending elections caused some volatility in the markets, particularly in the UK and Europe, which underperformed as a result. However, the managers believe that there is an opportunity here as valuations are very attractive, and there are good, solid companies that have been overlooked for some time.

In the T. Bailey multi-asset funds, the diversifying holdings (commodities, investment trusts and absolute return funds) carried the portfolio in the second quarter for a range of idiosyncratic reasons. This led to outperformance for the period over the T. Bailey Global Thematic Equity Fund, showing the importance of owning a range of different asset classes, particularly when there is a lot of political and macro uncertainty. Hipgnosis (a listed company that owns the rights to over 150 songs) was the strongest performer as private equity recognised the value on offer and bid accordingly. The stock gained nearly 50% in the quarter and the managers sold this position in April. Copper was also a key contributor benefitting from the breadth of the AI theme, which points to greater electrification infrastructure against a limited supply of the metal.

The energy transition theme was a laggard towards the end of the quarter (having performed very well at the beginning of the period). This is despite the positive outlook for earnings over the longer term, reduced pressure from interest rates, and relatively low valuations in the sector. Hence, the managers still have conviction in this theme.

Over the quarter, the managers trimmed positions in the Polar Capital Insurance Fund and copper to take some profits. They also reduced their exposure to the broad Japanese market via the Amundi Prime Japan ETF to reduce the risk of a reversal in the Japanese Yen, which could hurt Japanese equities in the short term. The proceeds were invested into the Gravis UK Infrastructure Income Fund, which gives exposure to listed UK infrastructure assets at large discounts that have the potential to benefit as interest rate pressures start to ease.

Lastly, JP Morgan Climate Change Solutions was sold (only held in the Global Thematic Equity Fund) as the fund manager is retiring. The proceeds were invested in Ranmore Global Equity, a fund focussed on buying companies they believe are selling for less than their underlying value. These companies can be of any size or geography and should be a less volatile addition to the funds. The managers note the underweight in US equities versus the benchmark, actively underweighting some of the big US tech stocks that are trading at high valuations.

Inflation and the future path of interest rates continue to dominate the mood of the markets, so significant exposure to bonds, commodities, and absolute return funds helps dampen any potential equity market volatility if there are any unexpected bumps in the road. Within the equity space, the managers continue to focus on owning well-run, cash-generative companies with strong balance sheets at the right price.

As ever, do get in touch with us if you have any questions.

Go well,

Featherstone