Key Market Insights

-

The US consumer is generally in a favourable position, and its corporate sector is robust. This Goldilocks scenario has resulted in high valuation multiples that are less appealing to long-term investors.

-

Both Europe and China have experienced economic challenges. Political unrest is likely to lead to more accommodative policies in Europe, whilst China has already acknowledged the necessity to stimulate its economy.

-

The T. Bailey funds are meaningfully diversified across high-quality assets that are priced for a more challenging economic environment than may actually unfold.

Review of the Markets

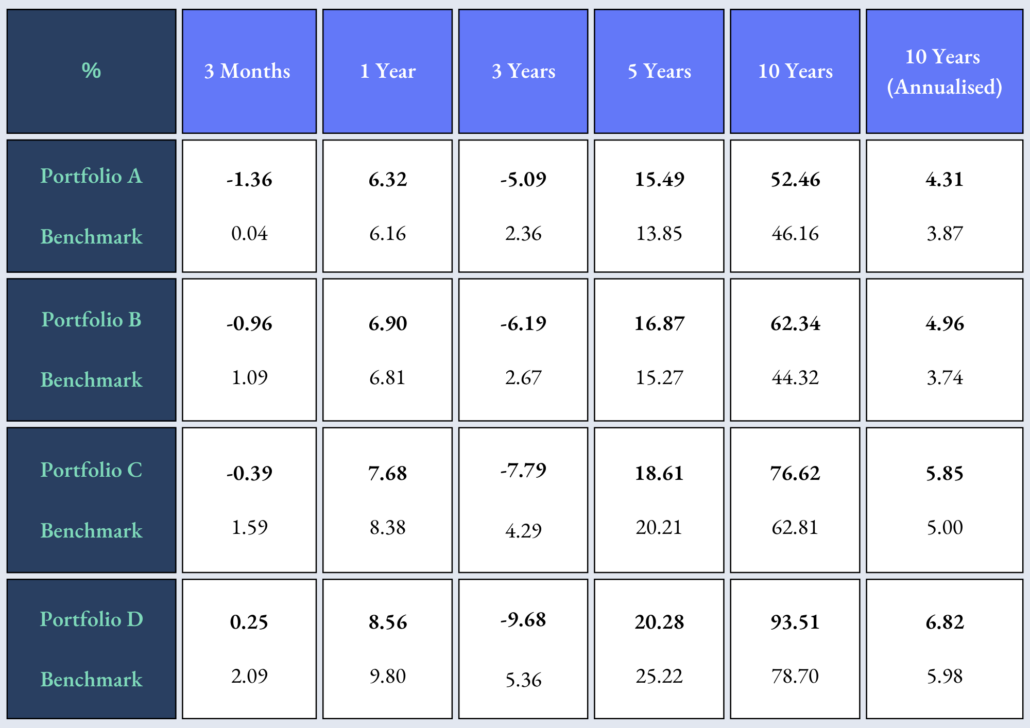

Overall, 2024 proved to be positive for risk assets despite widespread concerns at the start of the year that inflation couldn’t be tamed without heightened recessionary risk. Contrary to these fears, economies were generally resilient and monetary concerns were outweighed by continued fiscal largesse and an acceptance of widening budget deficits. The T. Bailey funds finished the year with gains in the range of 5.5% to 8.5%. However, the final quarter was mixed, with the T. Bailey Global Thematic Equity and Multi-Asset Growth funds gaining marginally whilst the Multi-Asset Dynamic and UK Responsibly Invested Equity funds lost ground. Exposure to UK assets had a part to play in this relative performance, particularly in the wake of the 30 October UK budget which levied additional costs on UK corporates and weighed on the positive momentum in UK stocks that had been building over the summer months. In contrast, the success of President Elect Trump in November’s US presidential election triggered a speculative environment for US assets. The anticipation of tax cuts and deregulation fueled optimism that led to a surge in large-cap US growth stocks, cryptocurrencies like Bitcoin and DogeCoin, gold, and the US dollar. The same policies have been widely interpreted as negative for the rest of the world.

However, the reality of election promises will become clearer post the 20 January 2025 inauguration. On a broader scale, macroeconomic conditions have shown improvement and, along with central banks signaling the potential for interest rate cuts, the risk of recession in the US or the global economy in the near future remains low. Generally, this should remain supportive for risk assets. However, there is also potential for inflation to linger and for longer-term borrowing rates to increase, particularly if government deficits aren’t controlled. For longer-term investors, this poses a challenge.

Earnings expectations and profit margins are high, particularly amongst the largest companies linked to advancements in artificial intelligence. This indicates investors should prepare for lower equity returns for the coming decade and points to diversification into a more balanced portfolio which seeks opportunities in areas that have been overlooked, and seeking assets that provide hedges for inflationary risks.

For a more in-depth look at some of the holdings, contributors, and detractors to the funds’ performance, please click here.

As ever, do get in touch with us if you have any questions.

Go well,

Featherstone